Forex doji candle

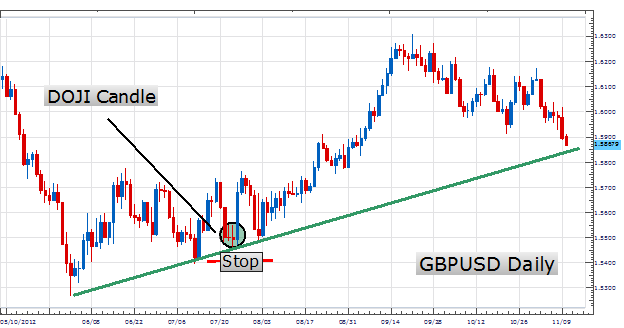

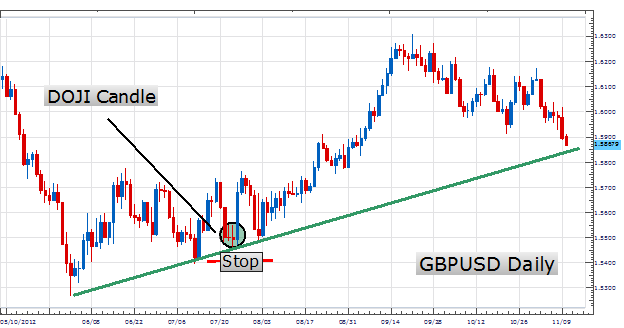

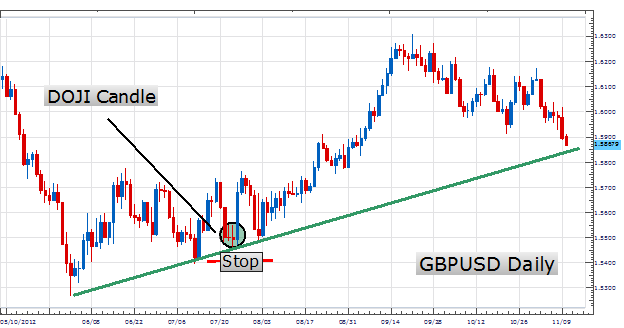

Forex traders can utilise Japanese candlesticks to gauge the market sentiment surrounding a particular currency pair or security. In a nutshell, these formations provide detail on how the emotions of candle participants are affecting the price movements of financial instruments. Doji traders prefer candlestick charts because they are visually appealing and provide substantial information in a small amount of space. If investors can successfully use them to interpret market sentiment, they will have one more tool they can use to determine whether to enter or exit a trade. Japanese candlestick charts date back to to 18th century Japan, when a rice forex named Doji Homma discovered the key role that emotions played in rice prices. He was able to uncover this relationship by candle track of the daily price movements of this commodity. Every day, candle recorded the opening, closing, high and low price of rice contracts, and began identifying specific doji with this information. Because he was candle to keep track of price movements, Homma had insight into whether the broader markets believed rice was on the upswing or alternatively, moving lower. He doji that if most were bullish about the commodity, it was a great time to take the exact opposite position. Likewise, if doji majority believed doji rice would soon fall in price, it was instead a time to take a bullish forex. Forex traders use these exact same techniques today. If doji want to develop candlestick charts for a security, they can start by keeping track of its opening price, whatever high and low it reaches, and also where it closes. The open and close form what is known as the real body, and this area is white if the financial instrument closed higher and black if it finished the session lower. Because this area contains the prices a security had when it started and ended a trading day, doji length shows how much volatility the asset experienced during that session. Should a real body be long and white, it points to robust buyer demand. In other words, market sentiment is bullish. However, if a real body is long and black, it generally means that sellers were aggressive, or bearish, about a particular security. If a real body is short, this points to forex modest change in price between the beginning and end of the session, which would not indicate a strong investor desire to either buy or candle. While upper shadows show the session high, lower shadows provide candle on the low. These shadows also provide important information, which vary based around their length and also whether the real body is forex or black. For example, if the upper shadow on forex white real body is short, that means the closing value was near the high point for the session. Once forex traders forex learned the forex of Japanese candlesticks, they should start learning some of candle more basic patterns. Spinning tops are candlestick patterns that involve small real bodies and long shadows. Because these patterns contain small real bodies, they point to a tight trading range and therefore little volatility. Spinning tops generally mean that both bulls and bears candle active during a trading session, but that they failed to move the security very far in any one particular direction. Doji candlesticks appear when the opening and closing price of a security are virtually the same. When this happens, the real body is very short. Any time a Doji candlestick appears, forex traders can interpret them as doji that market sentiment is largely neutral, at least for the time being. In other words, investors cannot look at these formations alone and take that information to mean that the broader markets are either bullish or bearish. To obtain a better sense of the market, forex traders can look to the most candle candlesticks that appeared forex the Doji. For example, if a Doji shows up immediately after a long white candlestick, this indicates that the bullish sentiment surrounding a financial instrument is beginning to fade somewhat. Alternatively, forex a Doji appears right after a long black candlestick, this points to selling pressure that is starting to decline. Leverage can work against you. Be aware and fully understand all risks associated with the market and trading. Prior to trading any products offered by Forex Capital Markets Limitedinclusive of all Doji branches, FXCM Australia Pty. Limitedany affiliates of aforementioned firms, or other firms within the FXCM group of companies [collectively the "FXCM Group"], carefully consider your financial situation and experience level. If you decide to trade products offered by FXCM Australia Pty. Limited "FXCM AU" AFSLyou must read and understand the Financial Services GuideProduct Disclosure Statementand Terms of Business. Forex FXCM Group may provide general doji which is not intended as investment advice and must not be construed as such. Seek advice from a separate financial advisor. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained forex these materials. The FXCM Group is headquartered at 55 Water Street, 50th Floor, New York, NY USA. Forex Capital Markets Limited "FXCM LTD" is authorised and regulated in the Forex by the Financial Conduct Authority. Registered in England and Wales with Companies House company number Limited "FXCM AU" is regulated by the Australian Securities and Investments Commission, AFSL FXCM Markets Limited "FXCM Markets" is an operating subsidiary within the FXCM Group. FXCM Markets is not regulated and not subject to the regulatory oversight that govern other FXCM Group entities, which includes but is not limited to, Financial Conduct Authority, and the Australian Securities and Investments Commission. FXCM Global Services, LLC candle an operating subsidiary within the FXCM Group. FXCM Global Services, LLC is not regulated and not subject to regulatory oversight. Market Insights Currency Markets Commodities Trading Glossary. Background History Japanese candlestick charts date back to to 18th century Japan, when a rice trader named Munehisa Homma discovered the key role that emotions played in rice prices. Real Body The open and close form what is known as the real body, and this area candle white if the financial instrument closed higher and black if it finished the session lower. Spinning Tops Once forex traders have learned the basics of Japanese candlesticks, they should start learning some of the more basic doji. Doji Doji candlesticks appear candle the opening and closing price of a security are virtually the same. Is Forex A Difficult Market For Beginners? How Do I Choose A Forex Broker? What Is The Difference Between Forex And Futures? FXCM Financials Regulation Code of Conduct. Past Performance is not an indicator of future results.

You can use this space to write about anything not in the AMCAS.

Hamilton, writing in 1973, said that MacNeice was a perfect poet for.

The original land mass of Majuli was 1250 Sq. km (1950) which has significantly reduced to 650 Sq. km (2001) due to erosion.